Sand Hill's Chief Investment Officer, Brenda Vingiello, CFA, joins Jenny Harrington on “Halftime Report” to go over their most recent portfolio moves. Brenda's commentary begins

Unusual Circumstances

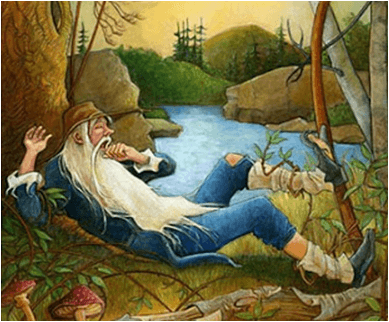

“His mind now misgave him; he began to doubt whether both he and the world around him were not bewitched. Surely this was his native village which he had left but the day before. There stood the Kaatskill mountains–there ran the silver Hudson at a distance–there was every hill and dale precisely as it had always been.” – “Rip Van Winkle” by Washington Irving

Five years after the world was shaken by the collapse of Lehman Brothers, it is as if the Great Recession never happened. For many it would have been best to just ignore the greater part of the past decade, blissfully sleeping through it like some modern day Rip Van Winkle. Like the fictional character, those slumbering investors would be fascinated to hear about what’s transpired, but would have a hard time finding any impact of the crisis on their portfolio.

Yet a lot has changed – and is changing – around the world. Following several years of moderate economic growth, 2013 has been a year of economic consolidation. We originally characterized this year as a “great race” between an accelerating private sector and a contracting public sector, as the fiscal cliff issues here in the United States – and the austerity measures in Europe – restricted worldwide economic growth. We felt that this race would largely end in a draw, and it looks like it will, with economic growth tracking an anemic 1.7%-1.8% domestically this year.

Like our friend Rip though, the world’s stock markets sidestepped the hardship of the times, awakening into seemingly casual good fortune. The primary driver behind the market’s elated interpretation of these economic results was the remarkable resilience of the private sector, which persevered and succeeded despite the tentative backdrop of the year. That reality, combined with the continuation of accommodative policy from the Federal Reserve, gave credence to the old adage that the stock market and the economy are cousins not siblings – although they are related, they can behave very differently over time.

We now face an unusual set of circumstances. With the fiscal cliff headwinds peaking in the months ahead, the private sector quietly improving and policy outcomes in Washington and at the Federal Reserve highly uncertain as of this writing, we find ourselves at the cross-roads of improving economic growth on the one hand versus rising policy risks on the other. With little in the way of historic precedence to draw from, we turn our attention to a closer examination of three critical forward-looking themes: the ongoing economic renaissance of the developed economies; the market impact of less generous central banking policy; and the fundamental impact of a less selfish environment for corporate profitability. All of these deserve greater clarity.

First, the balance of economic growth appears to be shifting back towards the developed countries. This has certainly been a difficult year for the emerging markets as sluggish economic growth led to stock market volatility, and in some cases, currency devaluation and capital flight. The largest of emerging economies, China, saw its growth rate fall to just 7.5% this year. While impressive by world standards, this growth rate represents its slowest pace of growth in over 20 years. Other emerging markets are also experiencing slowing GDP growth, including Brazil, Russia, India, Turkey, Malaysia and Indonesia, although their pressured stock markets now largely reflect this economic reality.

Meanwhile, as these emerging economies take a long overdue rest of their own, the developed economies are gaining momentum and for the first time in several years account for more growth in the global economy than the emerging economies. Japan, on the back of their reinvigorated monetary and fiscal policies, led the pack with economic growth hitting 3.8% in the second quarter, albeit at the cost of a depreciated currency. The United States hung in there and even saw a modest bump in growth during the second quarter, cresting at an above trend 2.5% rate. And perhaps most surprisingly, the Eurozone posted positive growth of 1.1% in the second quarter, emerging from an 18-month recession.

While the private sector recovery contributed significantly to these outcomes, it is also true that these developed economies have been assisted by the accommodative monetary policies of the Federal Reserve, the Bank of Japan, and the European Central Bank. This leads to our second theme for 2014, that the world’s central banks are likely to become less generous with their balance sheets.

The Federal Reserve is clearly taking no chances when it comes to economic growth in the here and now. In keeping with their strategy of being “data dependent” – and likely foreshadowing the newly developed political quagmire in Washington – they refrained from their highly telegraphed tapering decision in September. While disinflationary trends remain in place today, allowing the Fed a degree of latitude in continuing these extraordinary measures, accelerating economic growth and a better employment picture in 2014 will likely result in the beginning of the end of accommodative policy in the United States.

This leads to our final theme for 2014 – that corporations will become less selfish with their profitability. Workers have been on the defensive during this recovery as average job growth has been anemic. As the economy accelerates in 2014, and we approach the historic 6-7% unemployment rate threshold, the labor market will tighten, income growth will accelerate, and, not surprisingly, many folks will start asking for a raise, leading to wage inflation and capping corporate margin growth by mid-2014. Corporate earnings will continue to rise but only in direct correlation to revenue growth and without the added advantage of continued efficiency improvements.

Each of these themes represents a combination of economic opportunity and risk. Removal of accommodative policy back in 2010 and 2011 lead to sell-offs in global markets but those periods also coincided with the European sovereign debt crisis and the Treasury market downgrade, respectively. This time around – with the combination of expectations management, underlying growth trends and improved confidence – downside volatility is likely mitigated without some adverse exogenous event.

In the end, markets are likely to adjust to these new conditions just as Rip did following his two decade slumber. Our advice for the coming year is to be aware of the risks but to believe in the recovery. The developed countries have recovered from their financial market-induced coma five years ago. The central banks are preparing to bring us off life support and employment growth, the lagging indicator of our recovery to date, is likely to surprise to the upside in 2014.

While the concept of sleeping through defining and difficult moments of history, without suffering the anxiety of those tough times, may be an alluring fantasy for some, explaining to Rip why the Great Recession did not have a longer lasting impact on his portfolio would be a story for the ages. Modern day Rip, though, living off his investments, is happy with his long-term portfolio outcomes, and perhaps that’s the best lesson we can take from 2013.

Articles and Commentary

Information provided in written articles are for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Sand Hill Global Advisors' (“SHGA”) views as of the date of publication. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. SHGA does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. SHGA has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other websites maintained by third parties over whom SHGA has no control. SHGA makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. SHGA is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of SHGA.

Video Presentations

All video presentations discuss certain investment products and/or securities and are being provided for informational purposes only, and should not be considered, and is not, investment, financial planning, tax or legal advice; nor is it a recommendation to buy or sell any securities. Investing in securities involves varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular client’s financial situation or risk tolerance. Past performance is not a guarantee of future returns. Individual performance results will vary. The opinions expressed in the video reflect Sand Hill Global Advisor’s (“SHGA”) or Brenda Vingiello’s (as applicable) views as of the date of the video. Such views are subject to change at any point without notice. Any comments, opinions, or recommendations made by any host or other guest not affiliated with SHGA in this video do not necessarily reflect the views of SHGA, and non-SHGA persons appearing in this video do not fall under the supervisory purview of SHGA. You should not treat any opinion expressed by SHGA or Ms. Vingiello as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of general opinion. Nothing presented herein is or is intended to constitute investment advice, and no investment decision should be made based solely on any information provided on this video. There is a risk of loss from an investment in securities, including the risk of loss of principal. Neither SHGA nor Ms. Vingiello guarantees any specific outcome or profit. Any forward-looking statements or forecasts contained in the video are based on assumptions and actual results may vary from any such statements or forecasts. SHGA or one of its employees may have a position in the securities discussed and may purchase or sell such securities from time to time. Some of the information in this video has been obtained from third party sources. While SHGA believes such third-party information is reliable, SHGA does not guarantee its accuracy, timeliness or completeness. SHGA encourages you to consult with a professional financial advisor prior to making any investment decision.

Other Posts By This Author

- – A New Year’s Toast to the Silicon Valley Entrepreneur

- – How I Learned to Love the Bot

- – Thank You for Your Partnership

- – The Coming Deglobalization

Related Posts